Payouts API

For introductory terms, how to request this service and more information, refer to Payouts.

Configuring the authentication

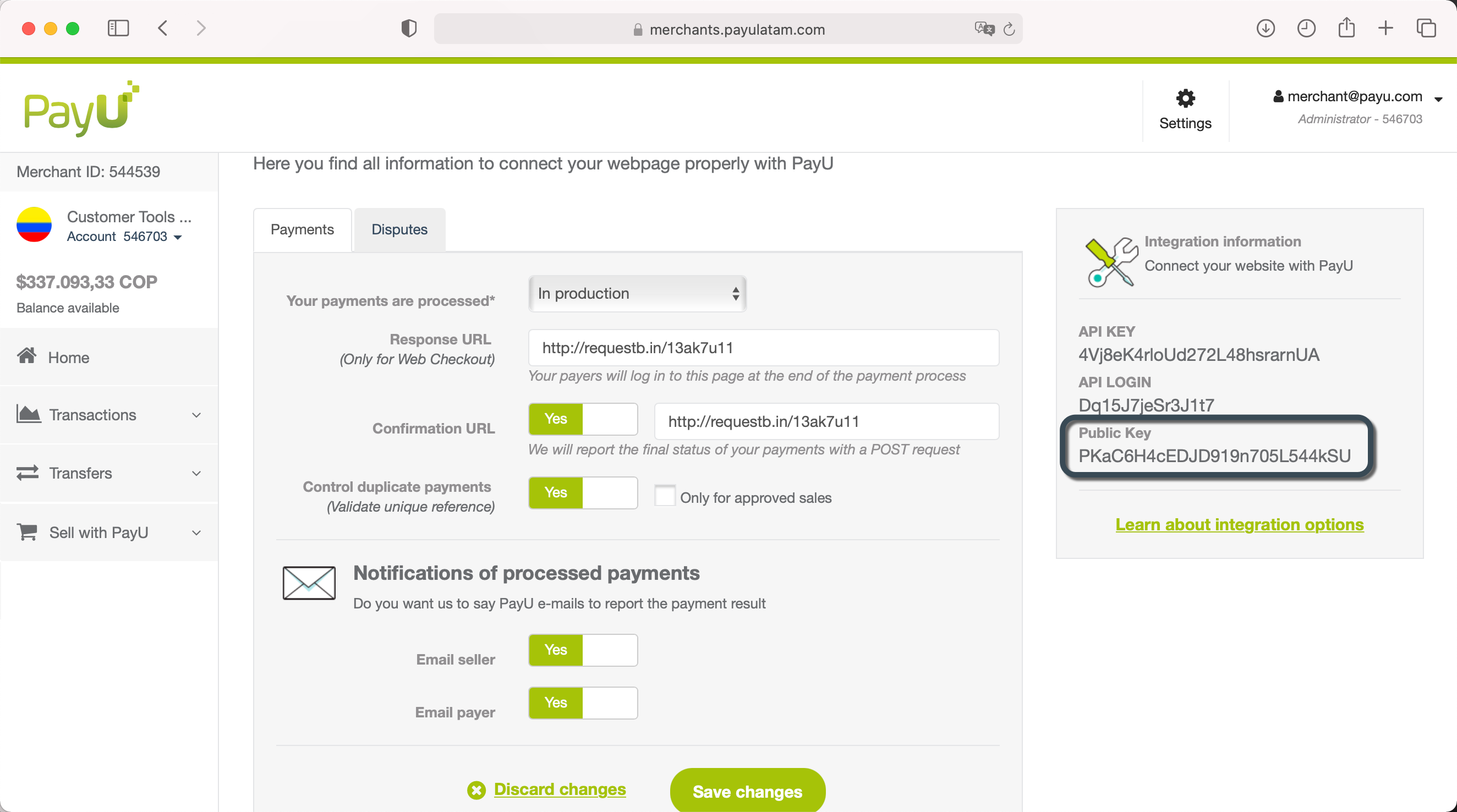

To use the methods to manage Payouts or WebHooks exposed by the Payouts service, you must include the Authorization and PublicKey headers:

- To configure the

Authorizationheader, call the authentication method provided by the Payouts service.

Example:

Bearer eyJhbGciOiJIUzI1NiJ9.eyJSb2xlIjoiQWRtaW4iLCJJc3N1ZXIiOiJJc3N1ZXIiLCJVc2VybmFtZSI6IkphdmFJblVzZSIsImV4cCI6MTYyODU0ODE2NywiaWF0IjoxNjI4NTQ4MTY3fQ.jrO3u5ramYKOvoNNb0TNfBuZkbYg1EvPmCDDYXFEO4c

- To configure the

PublicKeyheader, use your Public Key which can be found in the PayU Module (Settings > Technical configuration > Public Key).

Available methods

Payouts API includes the following methods:

- Authentication

- Request payout

- Cancel payout request

- Create or update a WebHook

- Delete a WebHook

- Query WebHooks

Authentication

The first step regardless of the method you want to request is to authenticate your account using the credentials provided by PayU.

The authentication method logs in the merchant returning the JWT Token generated to use the services exposed by Payouts. This token is available during 10 minutes after its creation.

API Call

To authenticate, send the request as follows:

POST

https://{env-api}.payulatam.com/v1.0/authenticate?accountId={accountId}&apiKey={apiKey}&apiLogin={apiLogin}

The value for the variable {env-api} displayed above is sandbox-transfers for testing and transfers for production mode.

| Parameter | Description | Mandatory |

|---|---|---|

| accountId | ID of the user account for each country associated with the merchant. | Yes |

| apiKey | Password provided by PayU. How do I get my API Key | Yes |

| apiLogin | User or login provided by PayU. How do I get my API Login | Yes |

Response example

{

"token": "Bearer eyJhbGciOiJIUzI1NiJ9.eyJSb2xlIjoiQWRtaW4iLCJJc3N1ZXIiOiJJc3N1ZXIiLCJVc2VybmFtZSI6IkphdmFJblVzZSIsImV4cCI6MTYyODU0ODE2NywiaWF0IjoxNjI4NTQ4MTY3fQ.jrO3u5ramYKOvoNNb0TNfBuZkbYg1EvPmCDDYXFEO4c"

}

Request payout

This method lets you create one or multiple Payouts request for payees which can be new or existing. As soon as you create the request, this moves along the available states for Payouts.

Note

You need to include two headers to use this method, refer to Configuring authentication for more information. Furthermore, you need to know your Merchant and account ID, you can get this information in your PayU Module.API Call

To create a Payout request, use the following URL:

POST

https://{env-api}.payulatam.com/v1.0/supplier-transfers/{merchantId}/{accountId}

The value for the variable {env-api} displayed above is sandbox-transfers for testing and transfers for production mode.

| Parameter | Description | Mandatory |

|---|---|---|

| merchantId | Merchant’s ID number in PayU’s system. | Yes |

| accountId | ID of the user account for each country associated with the merchant. | Yes |

Both parameters can be found in your PayU module.

Variables for request and response

Request parameters

| Field name | Format | Size | Description | Mandatory |

|---|---|---|---|---|

| transfers | List | List of the transfers you want to create. | Yes | |

| transfers[n] > value | Numeric | Amount to be transfer from your funds. The currency of this amount is the one configured in your PayU account | Yes | |

| transfers[n] > bankAccount | This object has the information of the bank account of the payee that will receive the payment. The payee can be existing or new. |

Yes | ||

| transfers[n] > bankAccount > id | Alphanumeric | 36 | Identifier of the Bank account of the payee. Send this parameter when you want to request a Payout for an existing payee. |

No |

| transfers[n] > bankAccount > supplierType | Alphanumeric | Min:11 Max:16 | Relationship type between you and your payee. You can choose one of the following values:

This parameter is mandatory when you are creating a payout request for a new payee. |

No |

| transfers[n] > bankAccount > accountNumber | Alphanumeric | Max:17 | Bank account number of the payee. This parameter is mandatory when you are creating a payout request for a new payee. |

No |

| transfers[n] > bankAccount > bankCode | Numeric | Min:3 Max:4 | Code of the bank who issued the account of the payee. See Bank codes. | No |

| transfers[n] > bankAccount > accountType | Alphanumeric | 2 | Set CC for Current account and CA for Saving account or Nequi*.This parameter is mandatory when you are creating a payout request for a new payee. *Nequi is available in Colombia. |

No |

| transfers[n] > bankAccount > country | Alphanumeric | 2 | Country of the bank account in format ISO 3166 Alpha-2. This parameter is mandatory when you are creating a payout request for a new payee. |

No |

| transfers[n] > bankAccount > documentNumber | Numeric | 50 | Identification number of the payee. If the documentType is NIT, the document number must have a hyphen (-) and the check digit. Example: 830140299-6.This parameter is mandatory when you are creating a payout request for a new payee. |

No |

| transfers[n] > bankAccount > documentType | Alphanumeric | 2 | Identification type of the payee. See Document types. This parameter is mandatory when you are creating a payout request for a new payee. |

No |

| transfers[n] > bankAccount > expeditionDate | Alphanumeric | 10 | Expedition date of the identity document of the payee. Format YYYY/MM/DD. |

No |

| transfers[n] > bankAccount > fullName | Alphanumeric | Full name of the payee. This parameter is mandatory when you are creating a payout request for a new payee. |

No | |

| transfers[n] > bankAccount > birthDate | Alphanumeric | 10 | Birth date of the payee. Format YYYY/MM/DD. |

No |

| transfers[n] > bankAccount > state | Alphanumeric | State of the Bank account. Set ACTIVE when you are creating a new payee. |

No | |

| transfers[n] > bankAccount > merchantId | Numeric | Identifier of your commerce in PayU. | No | |

| transfers[n] > description | Alphanumeric | Additional information of the payout. | No |

Response parameters

| Field name | Format | Size | Description |

|---|---|---|---|

| totalSuccessful | Numeric | Number of payouts successfully created. | |

| totalFailed | Numeric | Number of payments that could not be created. | |

| successfulItems | List | List of items that were successfully processed. | |

| successfulItems[n] > processingStatus | Alphanumeric | 7 | Status of the Payout request. For successful transactions, the value is SUCCESS |

| successfulItems[n] > paymentOrderId | Alphanumeric | 36 | Id generated for the payout request. Use this id to cancel the request. |

| successfulItems[n] > value | Numeric | Amount of the request. | |

| successfulItems[n] > bankAccount | This object has the information of the bank account that will receive the payment. | ||

| successfulItems[n] > bankAccount > processingStatus | Alphanumeric | 7 | Bank account registration status. For successful registrations, the value is SUCCESS. |

| successfulItems[n] > bankAccount > id | Alphanumeric | 36 | Identifier of the registered Bank account. |

| successfulItems[n] > bankAccount > supplierType | Alphanumeric | Min:11 Max:16 | Relationship type selected for the payee. |

| successfulItems[n] > bankAccount > accountNumber | Alphanumeric | Max:17 | Bank account number of the payee. |

| successfulItems[n] > bankAccount > bankCode | Numeric | Min:3 Max:4 | Code of the bank who issued the account of the payee. See Bank codes. |

| successfulItems[n] > bankAccount > bankName | Alphanumeric | Bank name of the payee. | |

| successfulItems[n] > bankAccount > accountType | Alphanumeric | 2 | Account type of the of the payee. |

| successfulItems[n] > bankAccount > country | Alphanumeric | 2 | Country of the bank account. |

| successfulItems[n] > bankAccount > documentNumber | Numeric | 50 | Identification number of the payee. |

| successfulItems[n] > bankAccount > documentType | Alphanumeric | 2 | Identification type of the payee. |

| successfulItems[n] > bankAccount > expeditionDate | Alphanumeric | 10 | Expedition date of the identity document of the payee. |

| successfulItems[n] > bankAccount > fullName | Alphanumeric | Full name of the payee. | |

| successfulItems[n] > bankAccount > birthDate | Alphanumeric | 10 | Birth date of the payee. |

| successfulItems[n] > bankAccount > state | Alphanumeric | State of the Bank account. | |

| successfulItems[n] > description | Alphanumeric | Additional information of the payout. | |

| failedItems | List | List of items that failed during processing. | |

| failedItems[n] > processingStatus | Alphanumeric | 7 | Status of the Payout request. For failed transactions, the value is FAILED. |

| failedItems[n] > failureMessages | List | List of error messages that generated the failure. | |

| failedItems[n] > value | Numeric | Amount of the request. | |

| failedItems[n] > bankAccount | This object has the information of the bank account that failed. This element has the same parameters than the object successfulItems[n].bankAccount. |

The following request example sends three payouts:

- The first and the second payout are requested for unregistered payees. The second one fails because the parameter

bankCodehas an invalid value. - The third payout is for a registered payee.

Request body:

{

"transfers": [

{

"value": 1500000,

"bankAccount": {

"supplierType": "RELATED_THIRD_PARTY",

"accountNumber": 2198922910000,

"bankCode": "007",

"accountType": "CC",

"country": "CO",

"documentNumber": 1026304116,

"documentType": "CC",

"expeditionDate": "1996-05-17",

"fullName": "Santiago Romero Pineda",

"birthDate": "1975-03-07",

"merchantId": 510608

},

"description": "First Payment"

},

{

"value": 2000000,

"bankAccount": {

"supplierType": "RELATED_PROVIDER",

"accountNumber": 2198922910330,

"bankCode": "8",

"accountType": "CA",

"country": "CO",

"documentNumber": 102688116,

"documentType": "CC",

"expeditionDate": "2001-05-17",

"fullName": "Juan Perez",

"birthDate": "1985-04-17",

"merchantId": 510608

},

"description": "Payment of supplies"

},

{

"value": 4500000,

"bankAccount": {

"id": "e202507e-5551-4b67-be2a-a2a834bf1438"

},

"description": "Registered supplier payment"

}

]

}

Response body:

{

"totalSuccessful": 2,

"totalFailed": 1,

"successfulItems": [

{

"processingStatus": "SUCCESS",

"paymentOrderId": "7202a9a7-ef51-4202-bd23-e604f9cbb25b",

"value": 1500000.00,

"bankAccount": {

"processingStatus": "SUCCESS",

"id": "e202507e-5551-4b67-be2a-a2a834bf1438",

"supplierType": "RELATED_THIRD_PARTY",

"accountNumber": "2198922910000",

"bankCode": "007",

"bankName": "BANCOLOMBIA",

"accountType": "CC",

"country": "CO",

"documentNumber": "1026304116",

"documentType": "CC",

"expeditionDate": "1996-05-16T05:00:00.000+00:00",

"fullName": "Santiago Romero Pineda",

"birthDate": "1975-03-06T05:00:00.000+00:00",

"state": "ACTIVE"

},

"description": "First Payment"

},

{

"processingStatus": "SUCCESS",

"paymentOrderId": "32740b81-5ecc-466c-bc09-699e6e5ceefb",

"value": 4500000.00,

"bankAccount": {

"processingStatus": "SUCCESS",

"id": "8f425a79-3f15-4e64-a1bf-2f7c087587ec",

"supplierType": "RELATED_THIRD_PARTY",

"accountNumber": "0200005555",

"bankCode": "013",

"bankName": "BBVA COLOMBIA",

"accountType": "CA",

"country": "CO",

"documentNumber": "81856522",

"documentType": "CC",

"expeditionDate": "2002-02-17T05:00:00.000+00:00",

"fullName": "Jorge Gutierrez",

"birthDate": "1986-02-11T05:00:00.000+00:00",

"state": "ACTIVE"

},

"description": "Registered supplier payment"

}

],

"failedItems": [

{

"processingStatus": "FAILED",

"failureMessages": [

"There is no registered bank with code: 8"

],

"value": 2000000,

"bankAccount": {

"processingStatus": "FAILED",

"supplierType": "RELATED_PROVIDER",

"accountNumber": "2198922910330",

"bankCode": "8",

"accountType": "CA",

"country": "CO",

"documentNumber": "102688116",

"documentType": "CC",

"expeditionDate": "2001-05-17T00:00:00.000+00:00",

"fullName": "Juan Perez",

"birthDate": "1985-04-17T00:00:00.000+00:00"

},

"description": "Payment of supplies"

}

]

}

Cancel payout request

This method lets you request the cancellation of a payout request. You can only request the cancellation of a Payout when its status is IN_PAYU_PROCESS or earlier. Refer to Payout states for more information.

Note

You need to include two headers to use this method, refer to Configuring authentication for more information. Furthermore, you need to know your Merchant and account ID, you can get this information in your PayU Module.API Call

To cancel a Payout request, use the following URL:

DELETE

https://{env-api}.payulatam.com/v1.0/supplier-transfers/{merchantId}/{accountId}/{paymentOrderId}

The value for the variable {env-api} is sandbox-transfers for testing and transfers for production mode.

| Parameter | Description | Mandatory |

|---|---|---|

| merchantId | Merchant’s ID number in PayU’s system. | Yes |

| accountId | ID of the user account for each country associated with the merchant. | Yes |

| paymentOrderId | Payout ID generated when the order was created by the Request payout service. | Yes |

Variables for request

| Field name | Format | Size | Description | Mandatory |

|---|---|---|---|---|

| comments | Alphanumeric | Reason to cancel the Payout request. | No | |

| pushPaymentId | Alphanumeric | Payout ID of the request to be cancelled. | No |

The following are the request and response bodies for this method.

Request body:

{

"comments": "Request cancellation for payout",

"pushPaymentId": "1f92a225-9559-4b7f-9739-e6bb27b8b838"

}

Response body:

{

"message": "Cancellation request received"

}

Create or Update a WebHook

This method lets you create or update a WebHook that allows you to configure a URL where PayU notifies states of a Payout via POST.

You can configure a WebHook for the following events:

- Transfer creation: sends a notification when a payout request is created. To enable these notifications, include the

TRANSFER_CREATIONvalue in the list parameterenabledEvents. - Transfer update: sends a notification when the sanction screening validation rejects the payee. To enable these notifications, include the

TRANSFER_UPDATEvalue in the list parameterenabledEvents. - Validation result: sends a notification when payee has approved the sanction screening validation and when the transfer has been rejected by the bank. To enable these notifications, include the

VALIDATION_RESULTvalue in the list parameterenabledEvents.

Click here to know the variables in the notifications.

Note

You need to include two headers to use this method, refer to Configuring authentication for more information. Furthermore, you need to know your Merchant and account ID, you can get this information in your PayU Module.API Call

- To create a WebHook, use:

POST

https://{env-api}.payulatam.com/v1.0/webhooks/{merchantId}/{accountId}

- To update a WebHook, use:

PUT

https://{env-api}.payulatam.com/v1.0/webhooks/{merchantId}/{accountId}

The value for the variable {env-api} is sandbox-transfers for testing and transfers for production mode.

| Parameter | Description | Mandatory |

|---|---|---|

| merchantId | Merchant’s ID number in PayU’s system. | Yes |

| accountId | ID of the user account for each country associated with the merchant. | Yes |

Variables for request and response

Request parameters

| Field name | Format | Size | Description | Mandatory |

|---|---|---|---|---|

| id | Alphanumeric | Id of the WebHook you want to update. This parameter is mandatory when updating a WebHook | No | |

| accountId | Numeric | ID of the user account for each country associated with the merchant. | Yes | |

| callbackUrl | Alphanumeric | URL used to receive the POST notifications sent by PayU according to the events selected. This URL must be unique per WebHook. |

Yes | |

| description | Alphanumeric | Description of the WebHook you want to create. | Yes | |

| enabledEvents | List | Max:3 | List of the events that will launch a notification to the configured URL when they occur. At least one event must be selected. Possibles values are: TRANSFER_UPDATE, TRANSFER_CREATION, VALIDATION_RESULT. |

Yes |

Response parameters

| Field name | Format | Size | Description |

|---|---|---|---|

| id | Alphanumeric | Id of the WebHook created. | |

| created | Date | Creation date of the WebHook. Format YYYY-DD-MM hh:mm:ss. |

|

| accountId | Numeric | ID of the user account for each country associated with the merchant. | |

| callbackUrl | Alphanumeric | URL used that will receive the POST notifications according to the events selected. |

|

| description | Alphanumeric | Description of the WebHook created. | |

| enabledEvents | List | Max:3 | List of the events selected. |

| status | Alphanumeric | 7 | State of the WebHook. By default, the state of the new WebHook is ENABLED. |

| processingStatus | Alphanumeric | 7 | State of creation or update of the WebHook. By default, this state is SUCCESS. |

The following are the request and response bodies for this method.

Request body:

{

"accountId": 1,

"callbackUrl": "https://wwww.callbackurltest.com/",

"description": "Web Hook For Test Swagger",

"enabledEvents": [

"TRANSFER_UPDATE",

"TRANSFER_CREATION",

"VALIDATION_RESULT"

]

}

Response body:

{

"processingStatus": "SUCCESS",

"id": "256dd74e-9187-4efb-8238-fa29bf8f587a",

"created": "2021-08-27T21:57:28.874+00:00",

"accountId": 1,

"callbackUrl": "https://wwww.callbackurltest.com/",

"description": "Web Hook For Test Swagger",

"enabledEvents": [

"TRANSFER_UPDATE",

"TRANSFER_CREATION",

"VALIDATION_RESULT"

],

"status": "ENABLED"

}

Delete a WebHook

This method lets you delete a WebHook previously created. As soon as you delete a WebHook, you stop receiving notifications.

Note

You need to include two headers to use this method, refer to Configuring authentication for more information. Furthermore, you need to know your Merchant and account ID, you can get this information in your PayU Module.API Call

To delete a WebHook, use the following URL:

DELETE

https://{env-api}.payulatam.com/v1.0/webhooks/{merchantId}/{accountId}/{id}

The value for the variable {env-api} is sandbox-transfers for testing and transfers for production mode.

| Parameter | Description | Mandatory |

|---|---|---|

| merchantId | Merchant’s ID number in PayU’s system. | Yes |

| accountId | ID of the user account for each country associated with the merchant. | Yes |

| id | ID the WebHook you want to delete. | Yes |

Response example

| Field name | Format | Size | Description |

|---|---|---|---|

| processingStatus | Alphanumeric | 7 | State of deletion of the WebHook. By default, this state is SUCCESS. |

| id | Alphanumeric | Id of the WebHook deleted. | |

| status | Alphanumeric | 7 | State of the WebHook. By default, the state of the deleted WebHook is DELETED. |

{

"processingStatus": "SUCCESS",

"id": "054e0fc5-a025-4a00-b666-95673c11dee1",

"status": "DELETED"

}

Query WebHooks

You can consult WebHooks related to your account either by their id or by the account id. Both methods are explained below.

Note

You need to include two headers to use this method, refer to Configuring authentication for more information. Furthermore, you need to know your Merchant and account ID, you can get this information in your PayU Module.Query WebHooks by Id

This method lets you consult the information of a specific WebHook using its id. To query a WebHook, use the following URL:

GET

https://{env-api}.payulatam.com/v1.0/webhooks/{merchantId}/{accountId}/{id}

The value for the variable {env-api} is sandbox-transfers for testing and transfers for production mode.

| Parameter | Description | Mandatory |

|---|---|---|

| merchantId | Merchant’s ID number in PayU’s system. | Yes |

| accountId | ID of the user account for each country associated with the merchant. | Yes |

| id | ID the WebHook you want to query. | Yes |

Response example

Response parameters

| Field name | Format | Size | Description |

|---|---|---|---|

| processingStatus | Alphanumeric | 7 | State of query. By default, this state is SUCCESS. |

| id | Alphanumeric | Id of the WebHook. | |

| created | Date | Creation date of the WebHook. Format YYYY-DD-MM hh:mm:ss. |

|

| accountId | Numeric | ID of the user account for each country associated with the merchant. | |

| callbackUrl | Alphanumeric | URL used that will receive the POST notifications according to the events selected. |

|

| description | Alphanumeric | Description of the WebHook. | |

| enabledEvents | List | Max:3 | List of the events selected. |

| status | Alphanumeric | 7 | State of the WebHook. By default, the state of the new WebHook is ENABLED. |

{

"processingStatus": "SUCCESS",

"id": "9628b74d-e2fb-40cc-b137-b156d1401641",

"created": "2021-08-28T00:52:26.206+00:00",

"accountId": 515058,

"callbackUrl": "https://wwww.callbackurltest.com/",

"description": "Web Hook For Test Swagger",

"enabledEvents": [

"TRANSFER_UPDATE",

"TRANSFER_CREATION",

"VALIDATION_RESULT"

],

"status": "ENABLED"

}

Query webhooks by account

This method lets you consult the information of all the WebHooks created in your account. To query the WebHook list, use the following URL:

GET

https://{env-api}.payulatam.com/v1.0/webhooks/account/{merchantId}/{accountId}

The value for the variable {env-api} is sandbox-transfers for testing and transfers for production mode.

| Parameter | Description | Mandatory |

|---|---|---|

| merchantId | Merchant’s ID number in PayU’s system. | Yes |

| accountId | ID of the user account for each country associated with the merchant. | Yes |

Response example

Response parameters

| Field name | Format | Size | Description |

|---|---|---|---|

| processingStatus | Alphanumeric | 7 | State of query. By default, this state is SUCCESS. |

| id | Alphanumeric | Id of the WebHook. | |

| created | Date | Creation date of the WebHook. Format YYYY-DD-MM hh:mm:ss. |

|

| accountId | Numeric | ID of the user account for each country associated with the merchant. | |

| callbackUrl | Alphanumeric | URL used that will receive the POST notifications according to the events selected. |

|

| description | Alphanumeric | Description of the WebHook. | |

| enabledEvents | List | Max:3 | List of the events selected. |

| status | Alphanumeric | 7 | State of the WebHook. By default, the state of the new WebHook is ENABLED. |

[

{

"processingStatus": "SUCCESS",

"id": "9628b74d-e2fb-40cc-b137-b156d1401641",

"created": "2021-08-28T00:52:26.206+00:00",

"accountId": 515058,

"callbackUrl": "https://wwww.callbackurltest.com.co/",

"description": "Web Hook For Test Swagger",

"enabledEvents": [

"TRANSFER_UPDATE",

"TRANSFER_CREATION",

"VALIDATION_RESULT"

],

"status": "ENABLED"

},

{

"processingStatus": "SUCCESS",

"id": "672497c2-00f8-4787-a396-4024042eaa20",

"created": "2021-09-15T16:04:49.131+00:00",

"accountId": 515058,

"callbackUrl": "https://wwww.callbackurltest.com.co/",

"description": "Web Hook For Test Swagger",

"enabledEvents": [

"TRANSFER_UPDATE",

"VALIDATION_RESULT"

],

"status": "ENABLED"

}

]