Tokenization API

Tokenization feature is available under customized commercial agreements. For more information, contact your sales representative.

Note

To integrate with the Tokenization API, send your requests to the following URLs based on your environment:

- Test:

https://sandbox.api.payulatam.com/payments-api/4.0/service.cgi - Production:

https://api.payulatam.com/payments-api/4.0/service.cgi

Available Methods

The Tokenization API includes methods to register and remove tokens, query them, and process payments using tokenized credit cards.

- Individual Credit Card Registration

- Massive Credit Card Registration

- Individual Token Removal

- Massive Token Removal

- Query Tokens

- Payments Using Tokenization

Individual Credit Card Registration

This feature allows you to register a customer’s credit card information and generate a token.

Parameters for Request and Response

Request

| Field Name | Format | Size | Description | Mandatory |

|---|---|---|---|---|

| language | Alphanumeric | 2 | Language used in the request. This determines the language of error messages. See supported languages. | Yes |

| command | Alphanumeric | Max:32 | Set to CREATE_TOKEN. |

Yes |

| merchant | Object | Object containing authentication data. | Yes | |

| merchant > apiLogin | Alphanumeric | Min:12 Max:32 | PayU provides this username or login. How do I get my API Login | Yes |

| merchant > apiKey | Alphanumeric | Min:6 Max:32 | PayU provides this password. How do I get my API Key | Yes |

| creditCardToken | Object | Object containing credit card details for tokenization. | Yes | |

| creditCardToken > payerId | Alphanumeric | Internal ID of the credit card holder. | Yes | |

| creditCardToken > name | Alphanumeric | Min:1 Max:255 | Name of the cardholder as displayed on the credit card. | Yes |

| creditCardToken > identificationNumber | Alphanumeric | Max:20 | Identification number of the cardholder. | Yes |

| creditCardToken > paymentMethod | Alphanumeric | 32 | Valid credit card payment method. See the available Payment Methods. | Yes |

| creditCardToken > number | Alphanumeric | Min:13 Max:20 | Credit card number. | Yes |

| creditCardToken > expirationDate | Alphanumeric | 7 | Expiration date in YYYY/MM format. |

Yes |

Response

| Field Name | Format | Size | Description |

|---|---|---|---|

| code | Alphanumeric | Transaction response: ERROR or SUCCESS. |

|

| error | Alphanumeric | Max:2048 | Error message returned when the transaction code is ERROR. |

| creditCardToken | Object | Object containing tokenized credit card details. | |

| creditCardToken > creditCardTokenId | Alphanumeric | Token generated from the credit card details. | |

| creditCardToken > name | Alphanumeric | Min:1 Max:255 | Cardholder name as sent in the request. |

| creditCardToken > payerId | Alphanumeric | Internal ID of the cardholder as sent in the request. | |

| creditCardToken > identificationNumber | Alphanumeric | Max:20 | Identification number of the cardholder as sent in the request. |

| creditCardToken > paymentMethod | Alphanumeric | 32 | Franchise of the tokenized credit card as sent in the request. |

| creditCardToken > maskedNumber | Alphanumeric | Min:13 Max:20 | Masked credit card number displaying the first six and last four digits. |

API Call

The following examples show request and response bodies.

Request Example:

{

"language": "es",

"command": "CREATE_TOKEN",

"merchant": {

"apiLogin": "pRRXKOl8ikMmt9u",

"apiKey": "4Vj8eK4rloUd272L48hsrarnUA"

},

"creditCardToken": {

"payerId": "10",

"name": "APPROVED",

"identificationNumber": "32144457",

"paymentMethod": "VISA",

"number": "4037997623271984",

"expirationDate": "2025/01"

}

}

Response Example:

{

"code": "SUCCESS",

"error": null,

"creditCardToken": {

"creditCardTokenId": "05440005-9111-4d34-aa86-deeb91983d54",

"name": "APPROVED",

"payerId": "10",

"identificationNumber": "32144457",

"paymentMethod": "VISA",

"number": null,

"expirationDate": null,

"creationDate": null,

"maskedNumber": "403799******1984",

"errorDescription": null

}

}

Request Example:

<request>

<language>es</language>

<command>CREATE_TOKEN</command>

<merchant>

<apiLogin>pRRXKOl8ikMmt9u</apiLogin>

<apiKey>4Vj8eK4rloUd272L48hsrarnUA</apiKey>

</merchant>

<creditCardToken>

<payerId>10</payerId>

<name>APPROVED</name>

<identificationNumber>32144457</identificationNumber>

<paymentMethod>VISA</paymentMethod>

<number>4916332769997505</number>

<expirationDate>2024/01</expirationDate>

</creditCardToken>

</request>

Response Example:

<creditCardTokenResponse>

<code>SUCCESS</code>

<creditCardToken>

<creditCardTokenId>46b7f03e-1b3b-4ce8-ad90-fe1a482f76c3</creditCardTokenId>

<name>APPROVED</name>

<payerId>10</payerId>

<identificationNumber>32144457</identificationNumber>

<paymentMethod>VISA</paymentMethod>

<maskedNumber>491633******7505</maskedNumber>

</creditCardToken>

</creditCardTokenResponse>

Massive Credit Card Registration

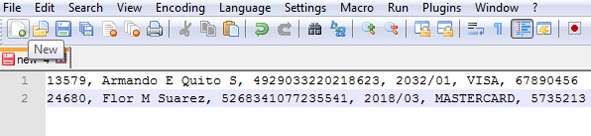

This feature allows you to register multiple credit cards stored in a .csv file and generate a token for each card.

Considerations

- Each record in the file must follow the specified structure and order, with fields separated by commas:

- Payer ID

- Full name

- Credit card number

- Expiration date

- Franchise

- Identification number

- The file must not contain a header.

- The file must be encoded using UTF-8. You need to implement a function to encode the content and send the encoded string in the

contentFileparameter. - The file cannot contain more than 10,000 records.

Example:

Parameters for Request and Response

Request

| Field Name | Format | Size | Description | Mandatory |

|---|---|---|---|---|

| language | Alphanumeric | 2 | Language used in the request. This determines the language of error messages. See supported languages. | Yes |

| command | Alphanumeric | Max:32 | Set to CREATE_BATCH_TOKENS. |

Yes |

| merchant | Object | Object containing authentication data. | Yes | |

| merchant > apiLogin | Alphanumeric | Min:12 Max:32 | PayU provides this username or login. How do I get my API Login | Yes |

| merchant > apiKey | Alphanumeric | Min:6 Max:32 | PayU provides this password. How do I get my API Key | Yes |

| contentFile | Alphanumeric | Base64-encoded string containing the credit card information as described above. | Yes |

Response

| Field Name | Format | Size | Description |

|---|---|---|---|

| code | Alphanumeric | Transaction response: ERROR or SUCCESS. |

|

| error | Alphanumeric | Max:2048 | Error message returned when the transaction code is ERROR. |

| id | Alphanumeric | Identifier for the process. |

API Call

The following examples show request and response bodies.

Request Example:

{

"language": "es",

"command": "CREATE_BATCH_TOKENS",

"merchant": {

"apiLogin": "pRRXKOl8ikMmt9u",

"apiKey": "4Vj8eK4rloUd272L48hsrarnUA"

},

"contentFile": "MDAxLE1hcnkgS2VsbGVyLDQwMjQwMDcxMzU0MTI2ODAsMjAyNC8wMSxWSVNBLDEyMzQ1NgowMDIsTWFyayBCcm93biw1MTA0ODQyNTA1ODE2MTcwLDIwMjMvMDUsTUFTVEVSQ0FSRCw3ODkwMTI="

}

Response Example:

{

"code": "SUCCESS",

"error": null,

"id": "b721abbc-a9cf-44c6-99ba-91393de2b5d6"

}

Request Example:

<request>

<language>es</language>

<command>CREATE_BATCH_TOKENS</command>

<merchant>

<apiLogin>pRRXKOl8ikMmt9u</apiLogin>

<apiKey>4Vj8eK4rloUd272L48hsrarnUA</apiKey>

</merchant>

<contentFile>MDAxLE1hcnkgS2VsbGVyLDQwMjQwMDcxMzU0MTI2ODAsMjAyNC8wMSxWSVNBLDEyMzQ1NgowMDIsTWFyayBCcm93biw1MTA0ODQyNTA1ODE2MTcwLDIwMjMvMDUsTUFTVEVSQ0FSRCw3ODkwMTI=</contentFile>

</request>

Response Example:

<creditCardTokenBatchResponse>

<code>SUCCESS</code>

<id>b721abbc-a9cf-44c6-99ba-91393de2b5d6</id>

</creditCardTokenBatchResponse>

Individual Token Removal

This feature allows you to remove a previously registered token.

Parameters for Request and Response

Request

| Field Name | Format | Size | Description | Mandatory |

|---|---|---|---|---|

| language | Alphanumeric | 2 | Language used in the request. This determines the language of error messages. See supported languages. | Yes |

| command | Alphanumeric | Max:32 | Set to REMOVE_TOKEN. |

Yes |

| merchant | Object | Object containing authentication data. | Yes | |

| merchant > apiLogin | Alphanumeric | Min:12 Max:32 | PayU provides this username or login. How do I get my API Login | Yes |

| merchant > apiKey | Alphanumeric | Min:6 Max:32 | PayU provides this password. How do I get my API Key | Yes |

| removeCreditCardToken | Object | Information of token to remove. | Yes | |

| removeCreditCardToken > payerId | Alphanumeric | Internal ID of the cardholder as sent in the request. | Yes | |

| removeCreditCardToken > creditCardTokenId | Alphanumeric | Token ID of the credit card to remove. | Yes |

Response

| Field Name | Format | Size | Description |

|---|---|---|---|

| code | Alphanumeric | Transaction response: ERROR or SUCCESS. |

|

| error | Alphanumeric | Max:2048 | Error message returned when the transaction code is ERROR. |

| creditCardToken | Object | Details of the removed token. | |

| creditCardToken > creditCardTokenId | Alphanumeric | Token ID of the credit card, as sent in the request. | |

| creditCardToken > name | Alphanumeric | Min:1 Max:255 | Cardholder name as sent in the request. |

| creditCardToken > payerId | Alphanumeric | Internal ID of the cardholder as sent in the request. | |

| creditCardToken > identificationNumber | Alphanumeric | Max:20 | Identification number of the cardholder as sent in the request. |

| creditCardToken > paymentMethod | Alphanumeric | 32 | Franchise of the tokenized credit card as sent in the request. |

| creditCardToken > maskedNumber | Alphanumeric | Min:13 Max:20 | Masked credit card number displaying the first six and last four digits. |

API Call

The following examples show request and response bodies.

Request Example:

{

"language": "es",

"command": "REMOVE_TOKEN",

"merchant": {

"apiLogin": "pRRXKOl8ikMmt9u",

"apiKey": "4Vj8eK4rloUd272L48hsrarnUA"

},

"removeCreditCardToken": {

"payerId": "10",

"creditCardTokenId": "46b7f03e-1b3b-4ce8-ad90-fe1a482f76c3"

}

}

Response Example:

{

"code": "SUCCESS",

"error": null,

"creditCardToken": {

"creditCardTokenId": "46b7f03e-1b3b-4ce8-ad90-fe1a482f76c3",

"name": "APPROVED",

"payerId": "10",

"identificationNumber": "32144457",

"paymentMethod": "VISA",

"number": null,

"expirationDate": null,

"creationDate": null,

"maskedNumber": "491633******7505",

"errorDescription": null

}

}

Request Example:

<request>

<language>es</language>

<command>REMOVE_TOKEN</command>

<merchant>

<apiLogin>pRRXKOl8ikMmt9u</apiLogin>

<apiKey>4Vj8eK4rloUd272L48hsrarnUA</apiKey>

</merchant>

<removeCreditCardToken>

<payerId>10</payerId>

<creditCardTokenId>46b7f03e-1b3b-4ce8-ad90-fe1a482f76c3</creditCardTokenId>4

</removeCreditCardToken>

</request>

Response Example:

<creditCardTokenResponse>

<code>SUCCESS</code>

<creditCardToken>

<creditCardTokenId>46b7f03e-1b3b-4ce8-ad90-fe1a482f76c3</creditCardTokenId>

<name>APPROVED</name>

<payerId>10</payerId>

<identificationNumber>32144457</identificationNumber>

<paymentMethod>VISA</paymentMethod>

<maskedNumber>491633******7505</maskedNumber>

</creditCardToken>

</creditCardTokenResponse>

Massive Token Removal

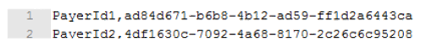

This feature allows you to remove tokens stored in a .csv file.

Considerations

- Each record in the file must follow this structure and order, separated by commas:

- Payer ID

- Token

- The file must not have a header.

- The file must be encoded in UTF-8. You need to implement functionality to encode the content and send the encoded string in the

contentFileparameter. - The file cannot contain more than 10,000 records.

Example:

Parameters for Request and Response

Request

| Field Name | Format | Size | Description | Mandatory |

|---|---|---|---|---|

| language | Alphanumeric | 2 | Language used in the request. This determines the language of error messages. See supported languages. | Yes |

| command | Alphanumeric | Max:32 | Set to REMOVE_BATCH_TOKENS. |

Yes |

| merchant | Object | Object containing authentication data. | Yes | |

| merchant > apiLogin | Alphanumeric | Min:12 Max:32 | PayU provides this username or login. How do I get my API Login | Yes |

| merchant > apiKey | Alphanumeric | Min:6 Max:32 | PayU provides this password. How do I get my API Key | Yes |

| contentFile | Alphanumeric | Base64-encoded string containing the tokens to remove. | Yes |

Response

| Field Name | Format | Size | Description |

|---|---|---|---|

| code | Alphanumeric | Transaction response: ERROR or SUCCESS. |

|

| error | Alphanumeric | Max:2048 | Error message returned when the transaction code is ERROR. |

| id | Alphanumeric | Identifier for the process. |

API Call

The following examples show request and response bodies.

Request Example:

{

"language": "es",

"command": "REMOVE_BATCH_TOKENS",

"merchant": {

"apiLogin": "pRRXKOl8ikMmt9u",

"apiKey": "4Vj8eK4rloUd272L48hsrarnUA"

},

"contentFile": "UGF5ZXJJZDEsYWQ4NGQ2NzEtYjZiOC00YjEyLWFkNTktZmYxZDJhNjQ0M2NhDQpQYXllcklkMiw0ZGYxNjMwYy03MDkyLTRhNjgtODE3MC0yYzI2YzZjOTUyMDg="

}

Response Example:

{

"code": "SUCCESS",

"error": null,

"id": "2562625d-9e4c-450a-b979-031feb033952"

}

Request Example:

<request>

<language>es</language>

<command>REMOVE_BATCH_TOKENS</command>

<merchant>

<apiLogin>pRRXKOl8ikMmt9u</apiLogin>

<apiKey>4Vj8eK4rloUd272L48hsrarnUA</apiKey>

</merchant>

<contentFile>UGF5ZXJJZDEsYWQ4NGQ2NzEtYjZiOC00YjEyLWFkNTktZmYxZDJhNjQ0M2NhDQpQYXllcklkMiw0ZGYxNjMwYy03MDkyLTRhNjgtODE3MC0yYzI2YzZjOTUyMDg=</contentFile>

</request>

Response Example:

<creditCardTokenBatchResponse>

<code>SUCCESS</code>

<id>2562625d-9e4c-450a-b979-031feb033952</id>

</creditCardTokenBatchResponse>

Query Tokens

Using this feature, you can retrieve information about tokenized credit cards. You can query using:

- Token ID: Retrieve details of a specific tokenized credit card.

- Payer ID: Retrieve all tokenized credit cards associated with a payer.

- Date range: Retrieve all tokenized credit cards created within a specific period.

Parameters for Request and Response

Request

| Field Name | Format | Size | Description | Mandatory |

|---|---|---|---|---|

| language | Alphanumeric | 2 | Language used in the request. This language is used to display error messages. See supported languages. | Yes |

| command | Alphanumeric | Max:32 | Set GET_TOKENS. |

Yes |

| merchant | Object | Object containing authentication data. | Yes | |

| merchant > apiLogin | Alphanumeric | Min:12 Max:32 | PayU provides this username or login. How do I get my API Login | Yes |

| merchant > apiKey | Alphanumeric | Min:6 Max:32 | PayU provides this password. How do I get my API Key | Yes |

| creditCardTokenInformation | Object | Parameters of the query. | Yes | |

| creditCardTokenInformation > creditCardTokenId | Alphanumeric | Token ID of the credit card to retrieve. Mandatory when querying by Token ID. | No | |

| creditCardTokenInformation > payerId | Alphanumeric | Unique identifier of the payer. Mandatory when querying by Payer ID. | No | |

| creditCardTokenInformation > startDate | Alphanumeric | 23 | Start date for queries by date range. Mandatory when querying by date range. Format: YYYY-MM-DDTHH:MM:SS, e.g., 2021-06-12T16:07:11. |

No |

| creditCardTokenInformation > endDate | Alphanumeric | 23 | End date for queries by date range. Mandatory when querying by date range. Format: YYYY-MM-DDTHH:MM:SS, e.g., 2021-06-12T16:07:11. |

No |

Response

| Field Name | Format | Size | Description |

|---|---|---|---|

| code | Alphanumeric | Transaction response: ERROR or SUCCESS. |

|

| error | Alphanumeric | Max:2048 | Error message returned when the transaction code is ERROR. |

| creditCardTokenList | Object | List of tokenized credit cards matching the query. | |

| creditCardTokenList > creditCardTokenId | Alphanumeric | Token generated for the credit card. | |

| creditCardTokenList > name | Alphanumeric | Min:1 Max:255 | Cardholder’s name as provided in the request. |

| creditCardTokenList > payerId | Alphanumeric | Unique identifier of the payer. | |

| creditCardTokenList > identificationNumber | Alphanumeric | Max:20 | Identification number of the credit card holder. |

| creditCardTokenList > paymentMethod | Alphanumeric | 32 | Credit card franchise (e.g., VISA, AMEX, MASTERCARD). |

| creditCardTokenList > creationDate | Alphanumeric | 19 | Date when the credit card was tokenized. |

| creditCardTokenList > maskedNumber | Alphanumeric | Min:13 Max:20 | Masked credit card number, showing the first six and last four digits. |

API Call

The following examples show request and response bodies.

Query by Token ID

Request Example:

{

"language": "en",

"command": "GET_TOKENS",

"merchant": {

"apiLogin": "pRRXKOl8ikMmt9u",

"apiKey": "4Vj8eK4rloUd272L48hsrarnUA"

},

"creditCardTokenInformation": {

"creditCardTokenId": "ad29f82a-31eb-43e9-8768-081c5f4cbaf0"

}

}

Response Example:

{

"code": "SUCCESS",

"error": null,

"creditCardTokenList": [

{

"creditCardTokenId": "ad29f82a-31eb-43e9-8768-081c5f4cbaf0",

"name": "APPROVED",

"payerId": "Merchant_Payer_ID_644",

"identificationNumber": "298928707",

"paymentMethod": "AMEX",

"creationDate": "2025-03-14T11:10:13",

"maskedNumber": "377813*****0001"

}

]

}

Request Example:

<request>

<language>en</language>

<command>GET_TOKENS</command>

<merchant>

<apiLogin>pRRXKOl8ikMmt9u</apiLogin>

<apiKey>4Vj8eK4rloUd272L48hsrarnUA</apiKey>

</merchant>

<creditCardTokenInformation>

<creditCardTokenId>ad29f82a-31eb-43e9-8768-081c5f4cbaf0</creditCardTokenId>

</creditCardTokenInformation>

</request>

Response Example:

<response>

<code>SUCCESS</code>

<error></error>

<creditCardTokenList>

<creditCardToken>

<creditCardTokenId>ad29f82a-31eb-43e9-8768-081c5f4cbaf0</creditCardTokenId>

<name>APPROVED</name>

<payerId>Merchant_Payer_ID_644</payerId>

<identificationNumber>298928707</identificationNumber>

<paymentMethod>AMEX</paymentMethod>

<creationDate>2025-03-14T11:10:13</creationDate>

<maskedNumber>377813*****0001</maskedNumber>

</creditCardToken>

</creditCardTokenList>

</response>

Query by Payer ID

Request Example:

{

"language": "en",

"command": "GET_TOKENS",

"merchant": {

"apiLogin": "pRRXKOl8ikMmt9u",

"apiKey": "4Vj8eK4rloUd272L48hsrarnUA"

},

"creditCardTokenInformation": {

"payerId": "Merchant_Payer_ID_644"

}

}

Response Example:

{

"code": "SUCCESS",

"error": null,

"creditCardTokenList": [

{

"creditCardTokenId": "ad29f82a-31eb-43e9-8768-081c5f4cbaf0",

"name": "APPROVED",

"payerId": "Merchant_Payer_ID_644",

"identificationNumber": "298928707",

"paymentMethod": "AMEX",

"creationDate": "2025-03-14T11:10:13",

"maskedNumber": "377813*****0001"

},

{

"creditCardTokenId": "e84d9ea2-e9df-44c3-98e4-5970e346ac11",

"name": "APPROVED",

"payerId": "Merchant_Payer_ID_644",

"identificationNumber": "3401859948",

"paymentMethod": "MASTERCARD",

"creationDate": "2025-03-14T11:24:27",

"maskedNumber": "547130******0003"

}

]

}

Request Example:

<request>

<language>en</language>

<command>GET_TOKENS</command>

<merchant>

<apiLogin>pRRXKOl8ikMmt9u</apiLogin>

<apiKey>4Vj8eK4rloUd272L48hsrarnUA</apiKey>

</merchant>

<creditCardTokenInformation>

<payerId>Merchant_Payer_ID_644</payerId>

</creditCardTokenInformation>

</request>

Response Example:

<response>

<code>SUCCESS</code>

<error/>

<creditCardTokenList>

<creditCardToken>

<creditCardTokenId>ad29f82a-31eb-43e9-8768-081c5f4cbaf0</creditCardTokenId>

<name>APPROVED</name>

<payerId>Merchant_Payer_ID_644</payerId>

<identificationNumber>298928707</identificationNumber>

<paymentMethod>AMEX</paymentMethod>

<creationDate>2025-03-14T11:10:13</creationDate>

<maskedNumber>377813*****0001</maskedNumber>

</creditCardToken>

<creditCardToken>

<creditCardTokenId>e84d9ea2-e9df-44c3-98e4-5970e346ac11</creditCardTokenId>

<name>APPROVED</name>

<payerId>Merchant_Payer_ID_644</payerId>

<identificationNumber>3401859948</identificationNumber>

<paymentMethod>MASTERCARD</paymentMethod>

<creationDate>2025-03-14T11:24:27</creationDate>

<maskedNumber>547130******0003</maskedNumber>

</creditCardToken>

</creditCardTokenList>

</response>

Query by Date Range

Request Example:

{

"language": "es",

"command": "GET_TOKENS",

"merchant": {

"apiLogin": "pRRXKOl8ikMmt9u",

"apiKey": "4Vj8eK4rloUd272L48hsrarnUA"

},

"creditCardTokenInformation": {

"startDate": "2021-06-23T12:00:00",

"endDate": "2021-06-25T12:00:00"

}

}

Response Example:

{

"code": "SUCCESS",

"error": null,

"creditCardTokenList": [

{

"creditCardTokenId": "1adc6940-ee7e-48c2-bb96-7d784de74964",

"name": "APPROVED",

"payerId": "20263841",

"identificationNumber": null,

"paymentMethod": "AMEX",

"number": null,

"expirationDate": null,

"creationDate": "2021-06-23T13:36:36",

"maskedNumber": "377813*****0001",

"errorDescription": null

},

{

"creditCardTokenId": "3e5f0d77-0f93-421f-9432-99b6430e845e",

"name": "Juan Perez",

"payerId": "158301",

"identificationNumber": null,

"paymentMethod": "VISA",

"number": null,

"expirationDate": null,

"creationDate": "2021-06-23T19:03:41",

"maskedNumber": "424242******4242",

"errorDescription": null

},

{

"creditCardTokenId": "ead0a090-18dc-41ad-9431-ab342af854a2",

"name": "LadyM",

"payerId": "0sS01",

"identificationNumber": "1234567890",

"paymentMethod": "AMEX",

"number": null,

"expirationDate": null,

"creationDate": "2021-06-24T11:48:21",

"maskedNumber": "377813*****0001",

"errorDescription": null

}

]

}

Request Example:

<request>

<language>es</language>

<command>GET_TOKENS</command>

<merchant>

<apiLogin>pRRXKOl8ikMmt9u</apiLogin>

<apiKey>4Vj8eK4rloUd272L48hsrarnUA</apiKey>

</merchant>

<creditCardTokenInformation>

<startDate>2021-06-23T12:00:00</startDate>

<endDate>2021-06-25T12:00:00</endDate>

</creditCardTokenInformation>

</request>

Response Example:

<creditCardTokenListResponse>

<code>SUCCESS</code>

<creditCardTokenList>

<creditCardToken>

<creditCardTokenId>1adc6940-ee7e-48c2-bb96-7d784de74964</creditCardTokenId>

<name>APPROVED</name>

<payerId>20263841</payerId>

<paymentMethod>AMEX</paymentMethod>

<creationDate>2021-06-23T13:36:36</creationDate>

<maskedNumber>377813*****0001</maskedNumber>

</creditCardToken>

<creditCardToken>

<creditCardTokenId>3e5f0d77-0f93-421f-9432-99b6430e845e</creditCardTokenId>

<name>Juan Perez</name>

<payerId>158301</payerId>

<paymentMethod>VISA</paymentMethod>

<creationDate>2021-06-23T19:03:41</creationDate>

<maskedNumber>424242******4242</maskedNumber>

</creditCardToken>

<creditCardToken>

<creditCardTokenId>ead0a090-18dc-41ad-9431-ab342af854a2</creditCardTokenId>

<name>LadyM</name>

<payerId>0sS01</payerId>

<identificationNumber>1234567890</identificationNumber>

<paymentMethod>AMEX</paymentMethod>

<creationDate>2021-06-24T11:48:21</creationDate>

<maskedNumber>377813*****0001</maskedNumber>

</creditCardToken>

</creditCardTokenList>

</creditCardTokenListResponse>

Payments Using Tokenization

To process payments using credit card tokens, include the transaction.creditCardTokenId parameter instead of the full credit card details. The examples below provide a high-level view of a one-step payment request.

Note

To process payments without a CVV, set thecreditCard.processWithoutCvv2 parameter to true in the payment request and omit the creditCard.securityCode parameter.By default, processing payments without a CVV is disabled. To enable this feature, contact your sales representative.

API Call

The following examples show the request bodies.

Request Example:

{

"language": "es",

"command": "SUBMIT_TRANSACTION",

"merchant": {

"apiKey": "4Vj8eK4rloUd272L48hsrarnUA",

"apiLogin": "pRRXKOl8ikMmt9u"

},

"transaction": {

"order": {

"Order information":""

},

"payer": {

"Payer information":""

},

"creditCardTokenId": "46b7f03e-1b3b-4ce8-ad90-fe1a482f76c3",

"creditCard": {

"securityCode": "123"

},

"extraParameters": {

"Additional request parameters":""

},

"type": "AUTHORIZATION_AND_CAPTURE",

"paymentMethod": "Card franchise",

"paymentCountry": "Processing country",

"deviceSessionId": "vghs6tvkcle931686k1900o6e1",

"ipAddress": "127.0.0.1",

"cookie": "pt1t38347bs6jc9ruv2ecpv7o2",

"userAgent": "Mozilla/5.0 (Windows NT 5.1; rv:18.0) Gecko/20100101 Firefox/18.0"

},

"test": true

}

Request Example:

<request>

<language>es</language>

<command>SUBMIT_TRANSACTION</command>

<merchant>

<apiKey>4Vj8eK4rloUd272L48hsrarnUA</apiKey>

<apiLogin>pRRXKOl8ikMmt9u</apiLogin>

</merchant>

<transaction>

<order>

<!-- Order information -->

</order>

<payer>

<!-- Payer information -->

</payer>

<creditCardTokenId>46b7f03e-1b3b-4ce8-ad90-fe1a482f76c3</creditCardTokenId>

<creditCard>

<securityCode>321</securityCode>

</creditCard>

<extraParameters>

<!-- Additional request parameters -->

</extraParameters>

<type>AUTHORIZATION_AND_CAPTURE</type>

<paymentMethod>{Card franchise}</paymentMethod>

<paymentCountry>{Processing country}</paymentCountry>

<deviceSessionId>vghs6tvkcle931686k1900o6e1</deviceSessionId>

<ipAddress>127.0.0.1</ipAddress>

<cookie>pt1t38347bs6jc9ruv2ecpv7o2</cookie>

<userAgent>Mozilla/5.0 (Windows NT 5.1; rv:18.0) Gecko/20100101 Firefox/18.0</userAgent>

</transaction>

<isTest>false</isTest>

</request>

For detailed information on processing payments, refer to the respective documentation based on the processing country.

Multiple Payments with Tokenization

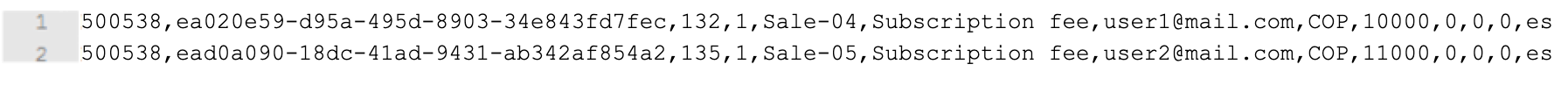

This feature allows you to process multiple payments using stored tokens from a .csv file.

Considerations

- Each record in the file must follow the specified structure and order, with values separated by commas:

- Account ID – The identifier of your PayU account.

- Credit card token

- Credit card security code

- Number of installments

- Sale reference

- Sale description

- Buyer’s email

- Currency ISO code – See accepted currencies.

- Total amount (including taxes)

- Tax value

- Base value for reimbursement

- Additional value

- Email language – Language used in emails sent to the buyer and seller. See supported languages.

- The file must not include a header.

- The file must be encoded in UTF-8. You need to implement a functionality to encode the content and send the encoded string in the

contentFileparameter. - The file cannot contain more than 10,000 records.

Example:

Parameters for Request and Response

Request

| Field Name | Format | Size | Description | Mandatory |

|---|---|---|---|---|

| language | Alphanumeric | 2 | Language used in the request. This determines the language of error messages. See supported languages. | Yes |

| command | Alphanumeric | Max:32 | Set to PROCESS_BATCH_TRANSACTIONS_TOKEN. |

Yes |

| merchant | Object | Object containing authentication data. | Yes | |

| merchant > apiLogin | Alphanumeric | Min:12 Max:32 | PayU provides this username or login. How do I get my API Login | Yes |

| merchant > apiKey | Alphanumeric | Min:6 Max:32 | PayU provides this password. How do I get my API Key | Yes |

| contentFile | Alphanumeric | Base64-encoded string containing credit card information. | Yes |

Response

| Field Name | Format | Size | Description |

|---|---|---|---|

| code | Alphanumeric | Transaction response: ERROR or SUCCESS. |

|

| error | Alphanumeric | Max:2048 | Error message returned when the transaction code is ERROR. |

| id | Alphanumeric | Identifier for the process. |

API Call

The following examples show request and response bodies.

Request Example:

{

"language": "es",

"command": "PROCESS_BATCH_TRANSACTIONS_TOKEN",

"merchant": {

"apiLogin": "pRRXKOl8ikMmt9u",

"apiKey": "4Vj8eK4rloUd272L48hsrarnUA"

},

"contentFile": "NTAwNTM4LGVhMDIwZTU5LWQ5NWEtNDk1ZC04OTAzLTM0ZTg0M2ZkN2ZlYywxMzIsMSxTYWxlLTA0LFN1YnNjcmlwdGlvbiBmZWUsdXNlcjFAbWFpbC5jb20sQ09QLDEwMDAwLDAsMCwwLGVzCjUwMDUzOCxlYWQwYTA5MC0xOGRjLTQxYWQtOTQzMS1hYjM0MmFmODU0YTIsMTM1LDEsU2FsZS0wNSxTdWJzY3JpcHRpb24gZmVlLHVzZXIyQG1haWwuY29tLENPUCwxMTAwMCwwLDAsMCxlcw=="

}

Response Example:

{

"code": "SUCCESS",

"error": null,

"id": "51c72d88-f707-45ca-ad59-4508140833a7"

}

Request Example:

<request>

<language>es</language>

<command>PROCESS_BATCH_TRANSACTIONS_TOKEN</command>

<merchant>

<apiLogin>pRRXKOl8ikMmt9u</apiLogin>

<apiKey>51c72d88-f707-45ca-ad59-4508140833a7</apiKey>

</merchant>

<contentFile>NTAwNTM4LGVhMDIwZTU5LWQ5NWEtNDk1ZC04OTAzLTM0ZTg0M2ZkN2ZlYywxMzIsMSxTYWxlLTA0LFN1YnNjcmlwdGlvbiBmZWUsdXNlcjFAbWFpbC5jb20sQ09QLDEwMDAwLDAsMCwwLGVzCjUwMDUzOCxlYWQwYTA5MC0xOGRjLTQxYWQtOTQzMS1hYjM0MmFmODU0YTIsMTM1LDEsU2FsZS0wNSxTdWJzY3JpcHRpb24gZmVlLHVzZXIyQG1haWwuY29tLENPUCwxMTAwMCwwLDAsMCxlcw=</contentFile>

</request>

Response Example:

<creditCardTokenBatchResponse>

<code>SUCCESS</code>

<id>b721abbc-a9cf-44c6-99ba-91393de2b5d6</id>

</creditCardTokenBatchResponse>